Property Tax

____________________________________________________________________________________________________________________________________

(B5) Owner-Occupied Residential Properties ($19 million)

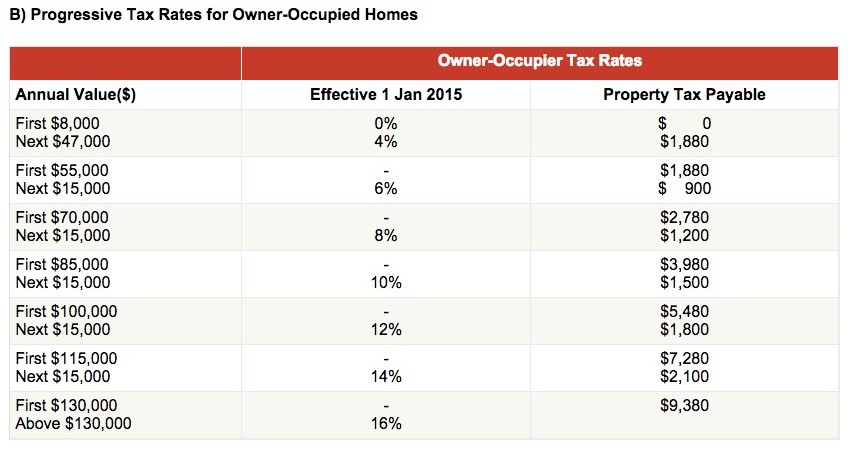

To increase the progressivity of the property tax structure, the tax structure for owner occupied residential properties will be revised.

About 950,000 owner-occupied residential properties with Annual Value of less than $59,000 will enjoy tax savings of up to $80. This will cost the Government $44 million per year. The top 1% ( including Good Class Bungalows GCBs) or about 12,000 of owner-occupied residential properties will pay higher property taxes, which will raise property tax revenue by $25 million per year. Overall, the changes will reduce property tax revenue by $19 million per year once fully implemented. The revised property tax structure will be phased in over two years starting from 1 January 2014.

(B6) Non-Owner-Occupied1 Residential Properties

Currently, the tax rate for let-out residential properties is a flat 10%. The tax structure for these investment properties will be revised to improve the progressivity of the tax regime. Let-out residential properties with Annual Value above $30,000 will be subject to higher property tax rates. These belong to the top one-third ( including Good Class Bungalows GCBs) of all let-out residential properties, or the top half of such private residential properties. The revised property tax rates will also be phased in over two years starting from 1 January 2014.

(B7) Removing the Property Tax Refund Concession for Vacant Properties

For consistency and equity in tax treatment, vacant properties will no longer enjoy property tax refunds with effect from 1 January 2014. This is in line with the principle that property tax is a tax on ownership of properties.

N.B: Non-owner-occupied residential properties include let out or vacant properties. Non-owner-occupied residential properties will be referred to as let-out residential properties hereafter in this document.

__________________________________________________________________________________________________________________

According to the Budget 2013, the Government will introduce progressive property taxes from 1 January 2014. Top-end residential properties including ( including Good Class Bungalows GCBs) with their higher assessed annual values (AVs) will be the hardest hit. The largest increases in property tax would apply to investment properties that are not occupied by their owners.

Assuming a 16,000 sqft Nassim Road GCB Good Class Bungalow with an AV of $360,000, the 2013 property tax payable for owner-occupiers worked out to be $20,060. In 2014, the property tax payable for owner-occupiers would increase to $43,230, and this amount would further inch up to $46,180 in 2015, reflecting a 116% and 130%

increase in property tax respectively. In 2016 and 2017, the property tax payable for owner-occupiers would be $46180.

If the Nassim Road GCB Good Class Bungalow is let out, the property tax payable in 2013 would be $36,000. In 2016, the property tax payable for let-out property would be $66000.

The increase in property taxes could affect upgraders and second time investors. The top end of the property market could face marginal downside risks associated with these revised tax measures, as it may be difficult to sell the GCB plots quickly. There would also be pressure to rent out the GCBs promptly, with the cessation of refund for vacant properties as stated in Budget 2013. However, the long term-market outlook remains positive, due to the exclusivity of GCB locations and the fact that GCB plots in Singapore are limited in land scarce Singapore. Singapore also had the highest percentage (17.1%) of millionaire households in the world, according to a 2012 global wealth report by the Boston Consulting Group. With an increasing number of high-net worth individuals and a growing population, the demand for GCBs is likely to grow.

_________________________________________________________________________________________________________________

Property tax Calculator:

https://www.iras.gov.sg/Tax%20Calculators/PT%20Private/Private.html

( Disclaimer: The calculator is correct as of 20 Nov 2014. Please check the IRAS website at www.iras.gov.sg for the latest version. The calculator provides only estimates based on the stated assumptions and your inputs. It may not provide for all possible scenarios)

Sample scenario of a Nassim Road GCB Good Class Bungalow:

2016 Annual value $150k owneroccupied Nassim Road GCB Good Class Bungalow $12580 property tax. 6.7%

2016 Annual value $150k letout Nassim Road GCB Good Class Bungalow $24000 property tax. 16%

2016 Annual value $150k vacant Nassim Road GCB Good Class Bungalow $24000 property tax. 16%

2013 Annual value $150k owneroccupied Nassim Road GCB Good Class Bungalow $7460 property tax. 4.97%

2013 Annual value $150k letout Nassim Road GCB Good Class Bungalow $15000 property tax. 10%

2016 Annual value $360k owneroccupied Nassim Road GCB Good Class Bungalow $46180 property tax. 12.8%

2016 Annual value $360k letout Nassim Road GCB Good Class Bungalow $66000 property tax. 18.3%

2013 Annual value $360k owneroccupied Nassim Road GCB Good Class Bungalow $20060 property tax. 5.57%

2013 Annual value $360k letout Nassim Road GCB Good Class Bungalow $36000 property tax. 10%

2016 Annual value $600k owneroccupied Nassim Road GCB Good Class Bungalow $84580 property tax. 14%

2016 Annual value $600k letout Nassim Road GCB Good Class Bungalow $114000 property tax. 19%

2013 Annual value $600k owneroccupied Nassim Road GCB Good Class Bungalow $34460 property tax. 5.7%

2013 Annual value $600k letout Nassim Road GCB Good Class Bungalow $60000 property tax. 10%

2012 Annual value $600k owneroccupied Nassim Road GCB Good Class Bungalow $34460 property tax. 5.7%

2012 Annual value $600k letout Nassim Road GCB Good Class Bungalow $60000 property tax. 10%

2011 Annual value $600k owneroccupied Nassim Road GCB Good Class Bungalow $34460 property tax. 5.7%

2011 Annual value $600k letout Nassim Road GCB Good Class Bungalow $60000 property tax. 10%

Property tax

________________________________________________________________________________________

I promise you the best price in the fastest time.

Good Class Bungalows SELL/ BUY/ RENT-

Call me @ HP 98-199-199 Serene Chua for a non-obligatory discussion.

$$ Referrals Appreciated $$

________________________________________________________________________________________

( Progressive Tax Rates from 1 Jan 2015)

( Progressive Tax Rates from 1 Jan 2015)  ( Progressive Tax Rates from 1 Jan 2015)

( Progressive Tax Rates from 1 Jan 2015)